- Digital Asset Insights

- Posts

- 💡 Crypto markets green amid institutional buzz

💡 Crypto markets green amid institutional buzz

PLUS: The latest 5-figure airdrop hits wallets...

Happy Monday all!

We’re back with the top crypto stories of the week 💡

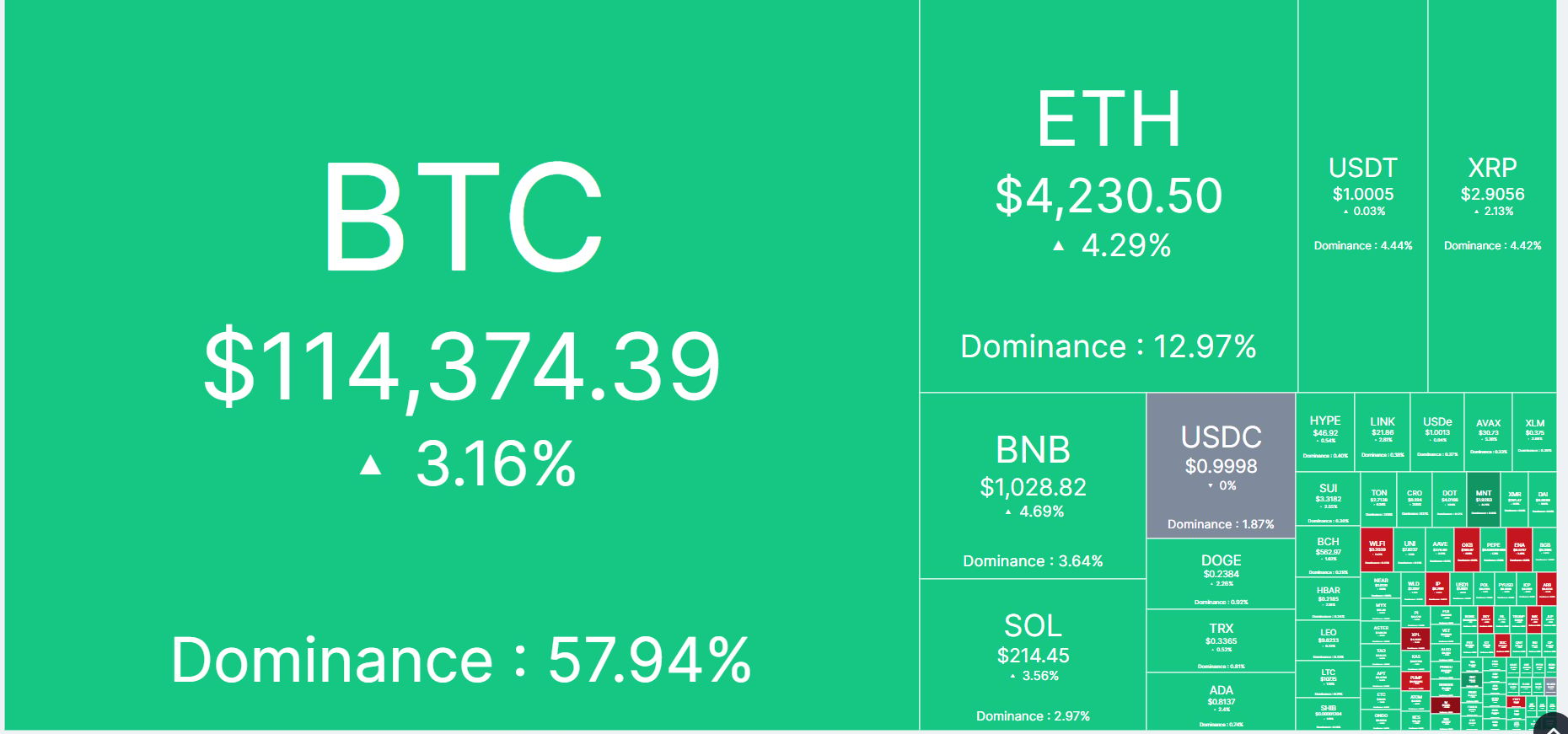

Source: CoinMarketCap Heatmap, 9/29/2025, 5:00pm EST

Bitcoin Bounces as Crypto Market Turns Green: Where Do Prices Go Next? 📈

Crypto market rebounds to $3.91 trillion, up 3.29% in 24 hours, with 95% of top 100 coins posting gains amid renewed institutional interest.

Bitcoin rose 1.85% to $113,985, briefly hitting $114,309; technical indicators show sideways consolidation with no clear trend.

Bitcoin’s RSI at 52 and ADX at 18 suggest a neutral, choppy market; 50-day EMA remains above 200-day EMA, but a potential “death cross” looms.

‘Myriad’ prediction market shows a 46% chance Bitcoin hits $125K before $105K, reflecting cautious sentiment despite recent gains.

Source: Decrypt

SWIFT to Add Blockchain Ledger to Global Payments Network 🌐

Swift will integrate a blockchain-based ledger into its global payments network to speed up settlement across 200+ countries.

The initiative, announced at Sibos in Frankfurt, has backing from over 30 financial institutions in 16 countries.

The first phase involves creating a prototype with Consensys focused on real-time, 24/7 cross-border payments.

Source: Blockworks

Stablecoin Market Cap Nears $300B as Line Between TradFi and DeFi is ‘Fading’ 💵

The stablecoin market cap is nearing $300 billion, up 18% in the past 90 days and more than doubling since early 2024.

Traditional financial giants like Mastercard are increasingly integrating stablecoins (USDG, USDC, PYUSD, FIUSD) to enable faster, cheaper cross-border payments.

Regulators and institutions, including the CFTC and European banks, are actively exploring stablecoin use cases such as tokenized collateral and euro-denominated stablecoins, aiming for broader adoption in 2026.

Major banks recognize the need to modernize legacy systems and leverage blockchain tech to stay competitive amid rising stablecoin relevance and yield differentials.

Source: Blockworks

Leaked Documents Expose $8 Billion Crypto Web Behind Russia's Sanctions Evasion 🚨

Leaked documents reveal an $8 billion crypto network allegedly used by Russia to bypass sanctions, involving multiple exchanges and crypto assets.

The scheme reportedly facilitated the movement of funds through a web of over 100 entities, including shell companies and crypto mixers.

Authorities are investigating the network, which reportedly enabled Russia to evade Western sanctions amid ongoing geopolitical tensions.

The leaked info highlights the growing use of crypto for illicit activities, raising concerns over regulatory oversight and enforcement.

Source: Decrypt

Hyperliquid’s Hypurr NFTs Settle at $55,000 Floor Amid Ecosystem Expansion 🐈

Hyperliquid’s Hypurr NFTs are now trading at a $55,000 floor price, just one day after launching on HyperEVM, its Layer 1 blockchain.

The 4,600 NFT collection has a total 24-hour volume of roughly $70 million, with HYPE token trading at $46.94, up 6.3% today.

About 86% of the collection is owned by 3,955 unique holders, with 11% listed for sale; most NFTs were allocated to early supporters and contributors.

The launch coincides with Hyperliquid’s ecosystem expansion, including the rollout of its native stablecoin USDH, now with a $1.44 million market cap.

Source: The Defiant

Start trading on HyperLiquid with our unique code for 4% off fees: https://app.hyperliquid.xyz/join/DAI

Reply